My client wanted to buy a boat. He’d been dreaming about it for a while. After spending the past five years working 60-hour weeks as a top-level executive, he decided now was the time to reward himself and his family. In talking with some of his colleagues, he came upon the idea that he could finance his boat by exercising his stock options. He came to me to discuss the best way to do that.

While I do help clients use income from exercised stock options to purchase boats, vacation homes, and other fun things, I always caution that stock options shouldn’t be treated as a savings account. To truly maximize the income potential from these benefits, you need to identify the best time and method for exercising your stock options as part of your equity compensation strategy. On many occasions, I’ve seen clients’ stock go up 10 percent in value, but the value of their options went up 20 or 30 percent. Had they not done any planning to be aware of this change, they could have missed out on the optimal time to exercise.

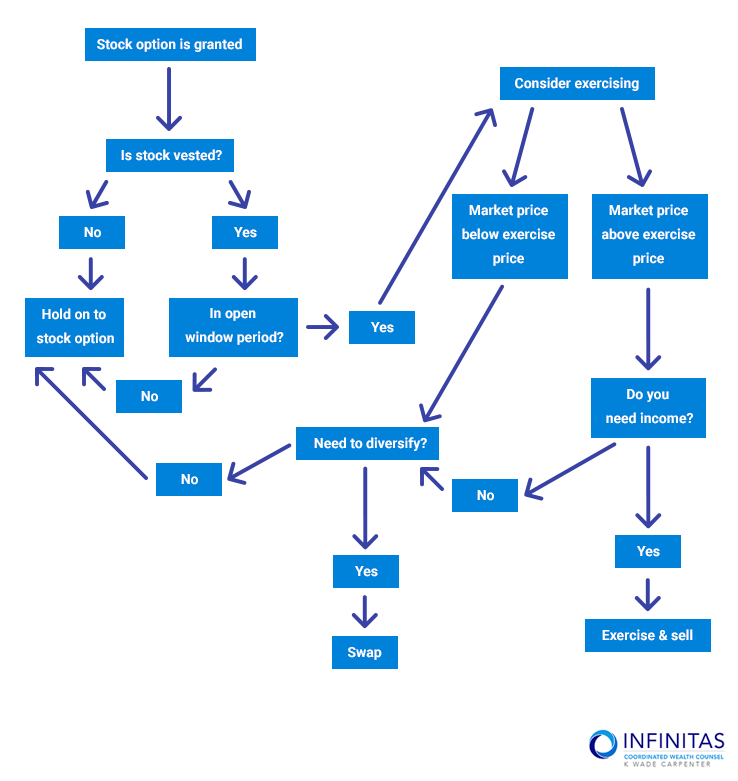

Below, you’ll find our extensive resource for developing equity compensation strategies. Here, you’ll learn about the many factors that affect your strategy and the methods for exercising your stock options. We’ll also cover the value a trusted wealth manager can offer as you develop and implement a strategy that maximizes the rewards from your years of hard work.